The online shopping cart abandonment rate is an alarming 70%!

The reasons might be mandatory sign-up, unsatisfactory payment methods, excessive commissions, complicated checkout process, insufficient security, or just that the planets aren’t aligned — you never know why.

One way to increase the percentage of completed deals is the integration of a comfortable and reliable payment gateway. In this article, we’ll compare the best payment gateways and share our insights about how to choose the best payment solutions and integrate them into your website! Enjoy!

Disclaimer: This article is based on our hands-on experience integrating various payment gateways into clients’ platforms. We do not include affiliate links and do not earn any commission from the payment gateways discussed. Our goal is to provide objective insights to help you make an informed decision.

What is a payment gateway?

Before diving headlong into comparing Paypal vs Stripe or Stripe vs Square, etc., we should understand the nuts and bolts of online payments. At first glance, it seems simple and quick. But if you look under the hood, you’ll see how complex the transaction process is, and you’ll get an idea of the multitude of services involved.

There are many misunderstandings about the terminology. Payment gateway and payment processor are often used interchangeably, even though they are not synonyms. Let’s learn how to tell them apart and talk about payment methods a bit later.

A payment gateway is a tool that allows customers to make payments online by securely transferring customers’ financial data to the payment processor, and then sending back a response to tell if the transaction was approved or denied.

A payment processor is an organization that obtains the customer’s data from the payment gateway and executes transactions between the customer’s bank account, or wallet, and the merchant's account. The payment processor also verifies the legitimacy of the customer’s card data. Payment processors manage refunds in case the payment was made accidentally, or the customer wants to return the purchased item.

Here is what the process looks like:

- The customer adds items to their shopping cart on a website and enters her payment data, which is then sent to the payment gateway.

- The payment gateway takes the financial data and securely sends it to the payment processor.

- The processor verifies the transaction and requests the money from the cardholder’s bank.

- If the bank approves the transaction, it transfers the money to the processor.

- The processor sends money to the merchant’s account (and, if necessary, to the online platform) and communicates the transaction status to the gateway.

- The gateway returns a message with payment status to the customer.

.png)

How to choose a payment gateway for eCommerce?

Choosing the best payment gateway for eCommerce is a sticky problem for many online businesses. What is the best payment gateway for your individual business? Nobody can say which is better: Square or PayPal, Authorize.net, or 2Checkout without a multi-sided payment gateway comparison.

To determine which gateway is best for you, you should identify the requirements for the payment gateway that will satisfy your business needs. Here is the list of criteria to base your choice on:

1. Identify the right payment methods for your audience

Before comparing payment gateways, it is necessary to list all the payment methods you would like to have on your website. The payment method is the way that customers pay for a product or service.

There is an array of methods available for online payments:

- Credit and debit cards (Mastercard, Visa, American Express)

- Digital wallets, or eWallets (PayPal, Venmo, AliPay, Amazon Pay)

- Mobile payments (Apple Pay, Google Pay)

- Cryptocurrency wallets

- ACH transfers (US domestic bank transfers), or eChecks International wire transfers

- Local payment methods (payment methods specific to certain countries)

- Gift cards

As reported by Statista, in 2024 credit cards remain the most popular in-demand payment methods in North America, being followed by digital and mobile payments, and debit cards.

ACH (Automated Clearing House) payments are also gaining traction today across the United States, largely due to simplifying money transferring and the introduction of same-day payments. Thus, in 2022, the number of ACH payments increased by 3% compared to 2021 reaching 30 billion payments with a total value of $76.7 trillion.

Not all payment gateways support all payment methods. Later on in our article, we’ll list the payment methods supported by different payment gateways.

2. Choose between classic gateways and all-in-one payment systems

In order to work with a payment processor, the platform owner has to create a merchant account. This is a special bank account for business purposes that allows its owner to accept online payments. Most modern gateways, however, do not require a merchant account as they use one.

- Classic gateways

Classic gateways function only after a business owner has established a merchant account and linked it to the payment gateway’s account. The process of setting up a merchant account may take several weeks and is not possible with all banks. Be ready for additional complications if you need to find a bank and prepare the necessary papers.

The gateways that require businesses to create merchant accounts usually charge lower fees and have better data security. Thus, if these benefits outweigh the advantages of other gateways, go with this type of gateway.

Braintree and Authorize.net are classic gateways. However, they also provide an opportunity to create a merchant account immediately via their partners.

- All-in-one payment systems

Most contemporary payment gateways don’t require a merchant account. This streamlines the process of integration of payment gateway into your website. Businesses can seamlessly create an account provided by the gateway. This allows businesses to avoid additional hassle with banks. PayPal, Stripe, and Dwolla represent this type of gateway. The integration process is much faster but fees are higher than at ‘classic’ alternatives. Note: In many cases, some business owners already have merchant accounts. Then, it is easier to use a ‘classic’ gateway. What’s more, not all ‘all-in-one’ gateways work with already existing merchant accounts. For example, Stripe supports only its own merchant account.

3. Understand the payment options that best suit your business model

Gateways also vary in payment options they support. By payment options, we mean the mechanism or payment plan.

The most popular payment options for eCommerce are:

- Escrow is a legal arrangement where a sum of money is temporarily held at a third-party (the platform’s) account to protect the buyer and the seller until a certain condition — a buyer confirms receiving the purchase or service, for instance — is met.

- Split payments are used when a single payment is divided into two or more simultaneous transactions, i.e. the cost of the purchased products and the platform fees or other charges from the payments for the goods or services.

- Payments in installments are an option to pay for goods or services in parts over time. This is very useful for medium and large purchases.

- Credit is the option when the customer can purchase now and pay later. In this case, the platform transfers the whole sum to the seller and later collects money from customers.

- Instant payouts are the ability to immediately send your earnings to your debit or credit card instead of waiting two or more business days.

- Recurring billing is repeated online payments charged to the customers' account automatically in predefined periods (weekly, monthly, yearly) to pay for services or goods like software, subscription-based services, donations, and more.

- A mass payout is an option that enables customers to pay multiple sellers at once Apart from convenience, customers will also save on flat rates for each transaction.

Depending on your business model, you may need various payment options.

- If you are going to start an online marketplace or store you need to consider options like mass payments, split payments, payments in installments, and credit.

- Peer-to-peer marketplaces can increase trustworthiness using escrow (or delay payments).

- Subscription-based businesses (SaaS, streaming platforms, eLearning) will benefit from recurring billing.

- Small businesses will appreciate instant payouts.

Therefore, when evaluating PayPal vs Square or Authorize.net vs Stripe, make sure that the chosen payment gateway supports all necessary options, no matter how good it is in other aspects.

4. Optimize your checkout experience to maximize conversions

The checkout process can be completed in two ways: being hosted and integrated.

- Hosted checkout

You may notice that sometimes when you click the Pay button, the website redirects you to another website where you must enter your payment details. This is how hosted gateways work.

The website owner shifts responsibility for data security to the payment gateway because all sensitive data input occurs on its page. The payment gateway takes all the responsibility for PCI compliance, data storage, and protection.

On top of that, hosted integration is easier and quicker and allows you to start taking payments almost at once.

The only downside to this approach is that it might affect your conversion rates with customers who are suspicious of redirects and don’t want to enter their data at an unknown page.

- Integrated checkout

Integrated payment checkout means that customers are never redirected to a third-party provider, and input all their financial data on the same website. The data is encrypted and sent via API to the processor. This way, the website owner is responsible for compliance with all local laws and international security regulations. Any breach of security will endanger your site’s reputation, not to mention the threat of fines and legal action.

Integration is more difficult and time-consuming and requires programming knowledge. On the flip side, customers stay on your website without redirection — a big plus when it comes to conversion rate and overall user experience.

Which to choose?

Some modern solutions provide both integrated and hosted approaches, for instance, PayPal. Hosted checkout is perfect for a startup that just wants to validate the idea. But in the long run, it's better to use an integrated method for a seamless user experience.

Looking for help with payment gateway integration?

Contact Us5. Ensure seamless integration with your eCommerce platform

The payment gateway must integrate smoothly with your eCommerce platform, whether you're using Shopify, WooCommerce, Magento, or a custom-built solution. Seamless integration is vital for maintaining efficiency across critical aspects of your online store, such as shopping carts, inventory management, and order processing. Without proper integration, not only does your development team face challenges, but your customers also experience interruptions during checkout, which can lead to abandoned carts and lost revenue.

What to look for?

- API & plugin support: Look for a gateway that offers comprehensive API documentation and existing plugins for your platform. As for payment api comparison, Stripe offers a robust API for developers, while PayPal and Square provide easy-to-install plugins for platforms like WooCommerce and Shopify.

- Custom-built solutions: If you have a custom-built platform, ensure the gateway’s API is flexible enough to allow deep customization. Gateways like Braintree offer developer-friendly SDKs that simplify integration with complex systems, ensuring you don't compromise on user experience while building a tailored solution.

- Scalability & future-proofing: Consider the long-term. Opt for gateways that not only integrate with your current platform but also support future growth. Stripe and Braintree are designed to scale with your business, ensuring you don’t need to switch solutions as your business expands or your platform evolves.

For example, a retailer using Shopify can easily integrate PayPal through its native plugin, enabling smooth transactions with popular payment methods like Venmo and credit cards, without any disruption in the checkout process. This helps maintain a seamless UX while reducing the technical overhead for the retailer.

6. Prioritize customer data security with the right compliance measures

When dealing with online payments, special care should be taken to protect data. There are several factors that you need to pay attention to when choosing a payment gateway.

- PCI DSS Compliance

Any website that accepts online payments must be secured according to Payment Card Industry Data Security Standard (PCI DSS) requirements.

PCI DSS is a data security standard for companies that take payments from major credit cards. The regulations have been in force since 2006. In that year, five payment systems (Visa, MasterCard, American Express, JCB и Discover) upgraded their level of protection, demanding merchants meet minimum security requirements when they store, process, and transmit cardholder data.

While PCI is not required by U.S. law (except in Nevada, Minnesota, and Washington), websites that ignore PCI DSS requirements put the sensitive data at risk, and may be fined for not complying.

Some payment gateways, mostly all-in-one services that do not require separate merchant accounts, provide payment solutions that are compliant with PCI DSS. Others leave the level of PCI compliance at your discretion.

Pay attention to the PCI requirements when choosing your payment gateway provider. If you want to avoid additional hassle with the regulations compliance, choose payment gateways that follow PCI. The main thing is to make sure your site adheres to the latest PCI requirements.

- 3D Secure

3D Secure (3-domain secure) is an additional security protocol created to protect online credit card and debit cards transactions from fraud. 3DS technology verifies each transaction and redirects customers to the 3DS page if something suspicious is detected. In case of fraud alert, additional identification through a password or PIN code is sent to the cardholder's phone by the bank via SMS.

According to European legislation, all merchants must be 3D Secure compliant. But even if you are based outside of EEA, but allow European customers to pay on your website, you should also provide them with 3DS.

Today, most payment gateways are 3DS compliant, but in some cases, website owners still need to enable this feature when integrating with the payment gateway.

- Machine learning security

Artificial intelligence and machine learning have been used to detect fraud for many years. By learning fraudulent schemes, the system is able to predict and prevent possible security breaches in advance. If you are concerned with data security, pay attention to payment gateway providers that have implemented machine learning in addition to standard rule-based security.

We must admit that all eCommerce payment solutions described here use excellent security measures.

Need to reinforce your website with a secure payment solution?

Hire us7. Boost customer satisfaction with a smooth payment experience

A frictionless checkout process is essential to reducing cart abandonment and boosting conversion rates. A well-chosen payment gateway can streamline this process with key features that enhance user experience, such as one-click payments, mobile optimization, and support for preferred payment methods. The global cart abandonment rate is close to 70%, and complicated or slow checkout processes are major contributors to this loss in sales.

How can the right payment gateway improve your checkout?

- One-click payments: Payment gateways like Amazon Pay and PayPal Express allow customers to bypass unnecessary form-filling and complete purchases with just one click. This drastically reduces friction, especially for repeat buyers.

- Mobile optimization: With over 50% of eCommerce traffic coming from mobile devices, it’s crucial that your gateway is optimized for mobile. Gateways like Stripe and Square provide mobile-first checkouts that adapt smoothly to different devices, ensuring customers don’t face issues when shopping from their phones or tablets.

- Support for preferred payment methods: Trust is key when it comes to payments. Offering options like Apple Pay, Google Pay, and PayPal can increase trust and reduce hesitation, making customers more likely to complete their transactions. A payment gateway that reduces steps and automates processes can significantly decrease cart abandonment.

For example, Stripe Checkout offers a mobile-first, customizable payment flow that supports local payment methods and one-click payments for returning customers, helping businesses provide a seamless shopping experience. In return, this enhances customer retention—improving profits over time, as Bain & Co. reports that a 5% increase in customer retention can lead to a 95% profit boost.

By choosing a gateway with these capabilities, you can improve the entire checkout process, offering customers a faster, more convenient, and trusted experience, which is key to driving sales and retention.

8. Discover key features that will set your payment gateway apart

Next, you should consider which features your service requires. To understand what you need, create user personas, i.e. different types of customers that can make payments on your website. For each persona, write sample stories — short descriptions of possible customer behavior, trying to imagine all possible user actions. Such an approach will help you identify which features you need.

Most of the payment gateways have standard features such as dashboards, reports, and notifications. However, gateways try to stand out from the competitors with unique functions.

In the next section, we’ll list the features of all payment gateways. If you compare, for example, Stripe vs Paypal vs Square, and you’ll see how different they are. For example, some payment services provide their merchants with tax tools that will calculate and pay taxes (even internationally) automatically. In addition, you should find out if certain features are available in the countries where you will do business.

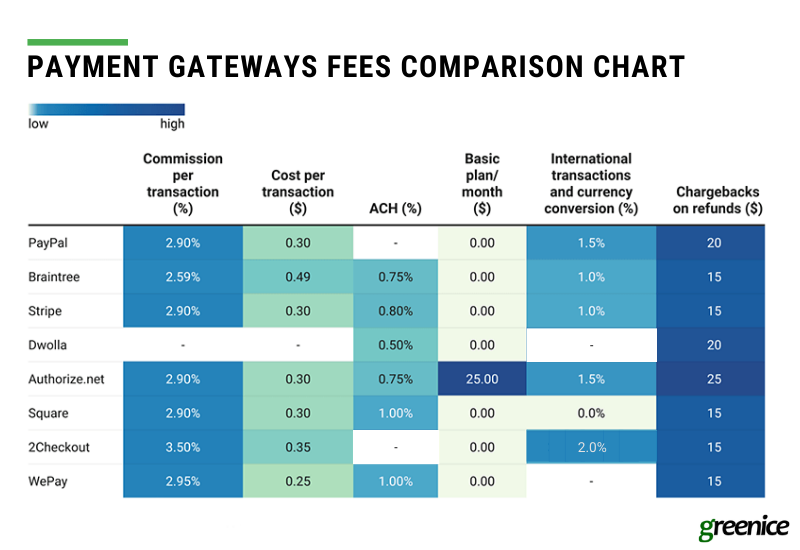

9. Balance costs and value with a payment gateway that fits your budget

One of the decision-making factors you should take into account when evaluating Stripe vs Square vs PayPal vs other payment providers is definitely the fees. They can be quite tricky because they change depending on the geography of the transaction, payment method, currency, and subscription type. Below, we have collected data on the fees for the payment gateways.

10. Effectively manage chargebacks to protect your business

Launching an online store or marketplace, you will eventually be faced with the question of how to manage chargebacks.

A chargeback is the amount of money returned to a customer in case of a fraudulent transaction, technical mistake, or merchant error. It is an important mechanism of consumer protection. A chargeback is not the same as a refund.

With a refund, the merchant simply sends money back to the customers for the returned items without any fees from the bank. With a chargeback, the customers make a monetary claim at the bank. For merchants, chargebacks are terribly inconvenient and expensive. In some cases, merchant accounts might even be terminated.

Not all gateways resolve disputes. Most of them provide guidelines on how to avoid chargebacks, and they also eagerly help you resolve disputes, and deal with banks. The fee for this service usually starts at $15.

Some payment gateways provide chargeback protection. For instance, comparing Square vs Stripe, the former covers up to $250 for each merchant’s chargeback per month, while Stripe provides an option to subscribe for ‘Chargeback Protection’ that will cost 0.4% of each transaction.

The takeaway? Check the chargeback fees and protection options.

11. Ensure excellent customer support to keep your business running smoothly

Square vs Stripe vs PayPal are all excellent and do their best to meet the needs of modern business. However, there is another factor that may tip the scales in favor of a provider when all other things are equal: customer support.

Helpful customer support is invaluable when dealing with gateway integration and resolving technical issues. Users often complain about inefficient support.

To check the competence of the support team, find out how easy it is to get in touch with them. Top service is available 24/7, and not only by email, but also by phone, messenger, and live chat. A good community forum and knowledge base are also excellent resources.

We can help you to make the right choice of a payment gateway

Let’s get in touch12. Consider global reach: countries and currencies

Expanding into global markets requires a payment gateway that can handle transactions across borders, supporting multiple currencies and offering localized features such as language and regional payment methods. However, the right gateway choice also depends on the location of the business and its customers. Certain gateways may offer more advantageous features or lower fees depending on the region in which you and your customers operate. Local regulations, transaction costs, and customer preferences can all impact the effectiveness of the gateway.

Customers are more likely to complete purchases when they can pay in their local currency and using familiar payment methods. A gateway that supports these options enhances trust and convenience. Moreover, transparent currency conversion rates prevent unexpected costs from deterring buyers, but the availability and fees for certain services like ACH payments or mobile wallets can vary depending on the location.

What to pay attention to?

- Multi-currency support: Look for gateways that handle multiple currencies without excessive conversion fees. For example, PayPal supports over 200 countries and 25 currencies, while Stripe supports 135+ currencies, making them strong options for international transactions.

- Localization features: Support for local languages and regional payment options is critical for building trust. Options like iDEAL in the Netherlands or Alipay in China can greatly increase the chances of a successful sale in those regions.

- Geographic reach: Not all payment gateways are available globally. Ensure the gateway operates in your country and the countries where your customers are based. For instance, Square is limited to only 6 countries, while 2Checkout (Verifone) supports over 200 countries, making it ideal for businesses with a global presence.

- Local business regulations: Some regions have specific rules or taxes that affect how payments can be processed. Ensure that your payment gateway complies with local regulations, especially when it comes to handling taxes, refunds, or chargebacks.

- Avoid conversion fees: Some gateways charge extra for currency conversion, so consider gateways like 2Checkout (Verifone) that offer transparent exchange rates with lower conversion fees for global transactions.

For example, business selling in Europe and Asia can use Braintree, which supports transactions in over 45 countries and multiple local payment methods, including WeChat Pay and Alipay. This flexibility ensures that your customers in different regions can pay using their preferred methods while minimizing extra costs for currency conversion.

13. Ensure scalability to support your business growth

As your business grows, so will your payment processing demands, both in terms of transaction volume and the complexity of your payment structures. Choosing a scalable payment gateway from the start is crucial to avoiding costly and time-consuming switches as your business expands. A well-suited gateway will seamlessly support higher transaction volumes, more complex processes like split payments and subscriptions, and the introduction of new products and services as your business diversifies.

What makes scalability important? A scalable gateway ensures that as your business expands into new markets and introduces new offerings, you won’t need to overhaul your entire payment infrastructure. This allows you to focus on growth without worrying about your technology holding you back.

For example, a rapidly growing SaaS company might choose Stripe because of its robust support for recurring billing, subscription management, and the ability to process payments in multiple currencies. As the company scales into new international markets, Stripe's flexible API and global infrastructure ensure a seamless transition, helping the business avoid the pitfalls of switching gateways as they grow.

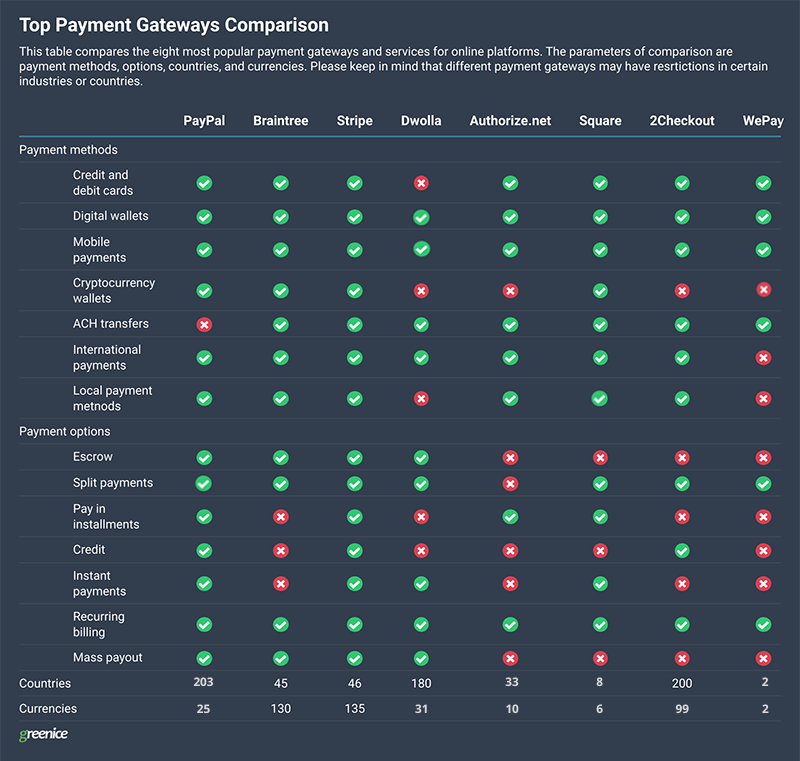

Payment gateway comparison chart

There is a slew of payment gateways used today. Some of the most popular payment gateways are:

Before we jump into a detailed description of each payment gateway, take a look at a comparison chart to get a bigger picture. The table encompasses all payment methods, options, countries, and currencies supported by each provider.

Payment gateway descriptions: Pros, cons, and features

Now let’s dig deeper into the details of each payment gateway to help you to make an informed decision.

PayPal

Paypal is probably the first provider that comes to mind when talking about payment solutions. It’s probably the most famous online payment system in the world. PayPal is available in 203 countries and supports 25 currencies. So if you plan to expand internationally, Paypal is a good option.

Paypal is estimated to be built into 1,851,684 websites in the US alone. Among the companies that integrated PayPal into their platforms, we can find such huge marketplaces as Upwork, Wish, Bonanza, eBay, and Etsy.

Today, Paypal is more than just a payment option, it’s a complete technical financial institution.

Pros:

- Easy integration. Branded PayPal payment buttons can easily be added to your site without technical assistance. All you need for hosted integration (that was explained above) is to register a PayPal Business account and edit your website’s HTML code. Just follow the instructions. If you want to integrate payments into your page without redirecting customers out of the site, however, consider dedicating this job to programmers.

- No merchant account is required. This drastically reduces the development time and expense. Not-for-profit discounts. PayPal provides lower fees for donations.

- Unsurpassed security. You do not need to worry about security because PayPal is fully PCI DSS and 3DS 2.0 compliant. PayPal also uses machine learning to prevent fraudulent transactions and validate customer legitimacy in real-time.

- Customer support. PayPal support answers quickly from Monday - Friday, 8:00 a.m. to 8:00 p.m. Central time. It also has live chat, phone, an online community, and a resolution center.

Cons:

- High price. PayPal charges slightly more than its competitors, and it can be difficult to figure out how it calculates the fees when all the extras — international transactions, currency conversions, chargebacks ‒‒ are included.

- Obligatory subscription. While the Standard account is free, it usually doesn’t offer sufficient customization for many eCommerce platforms. To enable further customization, you’ll have to activate the PayPal Pro plan for $30 per month.

- No ACH. PayPal processes credit and debit cards, PayPal wallet payments, and some alternative payment methods. For processing ACH, it requires Braintree integration.

Special features:

- Tax calculator — automatically calculates the sales tax for domestic or international payments. It prevents double taxation or applying several sales tax rates to a single purchase.

- ‘Pay-in-4’ — allows customers to split payments into 4 parts paid every two weeks over two months without interest.

- ‘PayPal Credit’ — transfers the whole sum of the purchase to the seller and later collects money from customers.

- Instagram checkout — allows companies in the US to accept payments straight from Instagram pages.

PayPal is best for:

- business owners without programming skills who want to quickly attach a payment gateway to their website and start using it right away;

- platforms selling inexpensive goods, avoiding extra charges for large-volume transactions, getting special fee offers, and also enjoying instant payouts;

- businesses that can benefit from unique PayPal features like Pay-in-4, PayPal Credit, and Instagram checkout.

Need to integrate PayPal?

Hire usBraintree

Starting as an independent company in 2007, Braintree sky-rocketed in 4 years to the 47th position among 500 fast-growing companies in Inc. magazine rankings. In 2013, it was acquired by PayPal when it wanted to expand its service with payment options specific to marketplaces.

Today, Braintree is found in 45 countries. Braintree is used by some of the world’s leading platforms including Pinterest, Airbnb, Uber, Dropbox, Yelp, Skyscanner, Opentable, among others.

Pros:

- Variety of payment options. In addition to traditional debit and credit cards, Braintree also processes payments made with digital wallets, Venmo, ACH, and cryptocurrencies.

- Integration with PayPal. Braintree serves PayPal accounts seamlessly. In exchange, PayPal integrates with Braintree to process ACH payments.

- Great customization. Braintree allows unlimited opportunities for setting up and customizing your payment solution. However, a developer is needed to integrate the service into your website. Luckily, Braintree provides 3 client SDKs (software development kits) to easily integrate and customize the service into a mobile or web platform.

- An extensive list of currencies. Braintree supports more than 100 currencies so that customers can pay in their local currency without conversion fees.

- Perks for online marketplaces. A service called Braintree Marketplaces offers customizable APIs dedicated specifically to create complex payment solutions that work with any online marketplace.

- Pleasant pricing for certain categories. Braintree has lower fees for international payments than other gateways. Let’s compare Braintree vs Paypal. Braintree’s fees are lower for standard transactions, as well as for international payments. It charges 1% when PayPal charges 1.5% plus a fixed fee depending on the country.

Cons:

- Poor support. There are many complaints that Braintree support does not reply promptly to customers' requests.

- Inefficient security. In spite of professed 3D security and PCI compliance, as well as fraud detection measures, there are multiple complaints of security breaches.

- Longer setup. Unlike PayPal, Braintree integration requires the platform owners to open a merchant account. If you want to speed up the process or avoid additional hassle with banks, you can use the merchant account provided by Braintree. Just fill out the required data.

- Developers are required. To integrate Braintree, you should be experienced in programming or hire a developer.

Special features:

- Braintree Marketplace — customizable payment environment for marketplaces.

- Integration with Venmo and PayPal — Braintree does not charge a fee for PayPal and PayPal Credit payments, unlike other payment gateways.

Braintree is best for:

- online marketplaces that can benefit from the convenient and well-designed multi-vendor platforms. For example, if your business model is based on commissions that have to be deducted from the payments, Braintree will easily split payments;

- businesses that already have a merchant account or do not mind creating one in a bank;

- businesses that operate with large transactions and want to save money. Braintree provides the lowest fees for transactions and also supports ACH direct payments;

- mobile platforms for which Braintree can provide an excellent user experience;

- businesses that need to receive payments from digital wallets, PayPal, or cryptocurrency accounts.

Stripe

Stripe, which operates in 46 countries, is one of PayPal’s biggest competitors.

Stripe is more than a payment gateway. Today, it’s a business facilitator that has increased opportunities for entrepreneurs from all over the globe. Stripe Atlas helps new U.S. companies take care of legal and tax documents.

Stripe deals with on-demand services, eCommerce, and crowdsourcing marketplace startups, and the subscription plan is called Stripe Connect. Some major platforms that use Stripe are Lyft, Deliveroo, Booking, and Instacart.

Pros:

- Accepting local payment methods. With Stripe, website owners can take payments from all major debit and credit cards as well as eWallets and even local payment methods like Alipay, WeChat, iDeal, or SEPA Direct Debit.

- Champion in supported currencies. The payment system processes payments in 135+ currencies — more than other platforms. Built-in regulations compliance. Making your marketplace compliant with regulations and standards can cause real panic for a business owner. Stripe Connect handles data safety in your platform and manages international payment regulations.

- Increased security. Besides following the PCI and 3D Secure standards, Stripe has created their own tool for fraud prevention. Stripe Radar scans every transaction and determines the risk level using machine learning. This system prevents fraud 32% better than standard measures.

- User verification. One of the most important features of any marketplace is seller verification. Stripe provides a built-in feature to identify risky vendors.

- Easy integration. There is no need to create a merchant account, so the implementation is quick and easy. All you need to do is enter your name, email address, home address, phone number, and the last four digits of your social security number. The company provides tools, libraries, and great documentation to help streamline integration.

- 24/7 support. Stripe can answer questions via help center, phone, live chat, and email.

Cons:

- Freezing accounts. There are many cases of accounts being frozen or canceled.

- Requires developers. If you are not tech-savvy, you’d better think about hiring a developer to integrate Stripe into your platform.

- Longer to access money. Comparing Stripe vs PayPal, the former processes your earnings a bit longer (on average 2 days). With PayPal, your funds are available immediately.

Special features:

- Stripe Connect — customizable environment for marketplaces.

- ‘Buy now, pay later’ — the seller is paid in full immediately, while the customer is allowed to pay by installments.

- Tax feature — automatic tax calculation and collection on Stripe transactions for US residents.

Stripe is best for:

- any kind of online marketplace startup that needs a fully-fledged payment solution;

- international eCommerce platforms that deal with multiple currencies, and local payment methods;

- businesses that are concerned with data security and want the best possible protection for their user’s sensitive data;

- business owners who want to start quickly and avoid the hassle of creating a merchant account;

- platform owners or startups that have a development team, or do not mind hiring programmers who will integrate Stripe;

- high-value goods or wholesale platforms with large transactions that would benefit from using ACH direct payments, and payments in installments.

Stripe was a perfect match for one of our projects - 4TradesOnly, a job board website for tradesmen. It was too much responsibility to store users’ personal data from credit cards. And Stripe solved this problem allowing companies and workers to make transactions without risk.

Dwolla

Dwolla is an American FinTech company that focuses on ACH payments for online businesses. The service made ACH payments frictionless and instantaneous while customary bank transfers take several days. If you need to accept cards or other payment methods, you can easily integrate any payment gateway with Dwolla.

In 2019, Dwolla announced a partnership with Currencycloud to enable its clients to receive international payments in 35 currencies in 180 countries.

Dwolla is used by Goat (sneakers marketplace), Veryable (on-demand marketplace for manufacturing, logistics, and warehouse labor), GetMyBoat (boat rental marketplace), Asserta Health (Healthcare startup), Homebase (property management solution), and many other modern websites.

Pros:

- No merchant account is needed. Dwolla allows businesses to receive payments without opening an account in the bank.

- Low transaction fees. Dwolla provides the lowest fees for ACH on the market. On top of that, the prices can be reduced as your volumes grow. To compare, Dwolla takes only $0.50 per ACH transfer, while most other providers charge $0.80 for the same transaction.

- Extended security. Dwolla partners with Plaid, modern security software. Plaid allows users to verify customers’ accounts in seconds, tokenize, and store their data. This way, your platform does not need to store sensitive financial info or be concerned about PCI compliance. Dwolla uses Sift Science, a machine learning system that identifies and prevents fraudulent transactions.

- Great customer support. On the Dwolla site, you’ll find instructions on how to integrate your platform with Dwolla’s API. Support is deemed excellent according to user reviews. The company provides each client with a dedicated manager who answers questions via Slack.

Cons:

- For tech-savvy only. To integrate Dwolla into your website, you need programming knowledge or hire a developer. However, if you are eager to code it all by yourself, Dwolla’s professionals will help you with integration.

- No other types of payments. For now, Dwolla supports only ACH transactions and does not accept credit cards or eWallets.

Special features:

- Same-day ACH payments — Dwolla is able to shorten the bank transfer period from 4-5 days to one business day.

Dwolla is best for:

- an online peer-to-peer marketplace. Dwolla automatically creates accounts for buyers and sellers that can be used the same way as a digital wallet. Dwolla places funds in an escrow account until the deal is confirmed;

- businesses for which it is essential to accept payments via bank transfer;

- the US market, as Dwolla processes international payments via a third party;

- platforms for which ACH transfers are the primary payment method.

Authorize.Net

Authorize.Net is a payment gateway provider belonging to Visa and is used by over 436,000 merchants in the United States alone.

The main difference from other payment methods is that Authorize.net requires the creation of a merchant account, and its competitors are all-in-one payment services. Nevertheless, the company does provide an ‘all-in-one’ plan that allows users to create a third-party merchant account via their partners — TSYS or Dharma Merchant Services.

Some companies that use Authorize.Net as their payment gateway are SignatureHardware, InvictaStores, ScienceNews, Liberty University, Hill Learning Center, Northern Arizona University, and PacificSource Insurance.

Pros:

- A large list of payment options. The payment system processes most domestic and international debit and credit cards, eChecks, and digital wallets.

- Increased security. Authorize.Net is famous as one of the most secure payment systems due to its advanced fraud detection mechanism. The service also uses Riskified, a machine-learning fraud solution that prevents fraudulent transactions. The company is so confident in its detection capabilities that it reimburses the full sum in case of an error.

- Flexible for connection with third-party merchant accounts. The gateway can connect with any merchant account and payment processor. This is ideal for platforms that already use payment infrastructure requiring additional payment options.

- 24/7 customer support. Help is available 24 hours a day, seven days a week. You can get in touch with the support team via phone, email, live chat, or social media.

Cons:

- Lengthy integration. The payment gateway requires the creation of a merchant account which may take several weeks.

- Monthly fee. Authorize.net charges $25 per month in addition to other fees.

- Requires developers. To integrate Authorize.net, you should be tech-savvy for API integration. Otherwise, you’ll need to hire developers to set up the payment gateway.

Special features:

- Automated payment updates — the system monitors and updates all changes on cards in case they expired, got lost, or were stolen.

- Digital invoicing — sending custom digital invoices to any customer via email.

Authorize.Net is best for:

- platforms that already have payment functionality but need extra payment options;

- those who have a merchant account;

- websites selling one or a small range of products, or services, and NPOs. The solution integrates ‘Buy Now’ and ‘Donate’ buttons easily into your website.

Square

Square was established in 2009 in San Francisco and its first product was a payment terminal that could connect to a smartphone audio jack to accept payments from cards.

In 2012, Starbucks invested $25 million into Square and started using the payment solution in their 7,000 restaurants. Starting in 2013, the company launched Square Market, which allows anyone to create a free online store with ordering and payment functionality.

Square was initially created as a point-of-sale (POS) solution, offering complete POS software and hardware systems for different industries. It is also a great payment service for certain business niches. Famous services that use Square are UberEats, Doordash, and Grubhub.

Pros:

- No merchant account is needed. Square provides its users with a merchant account on registration similar to Stripe.

- Increased security. Square uses machine learning to monitor transactions and detect potential fraud more effectively than rule-based mechanisms.

- Feature-rich solution. Comparing Square versus PayPal or Stripe, Square provides not only payment solutions but also a wide range of features for retailers and restaurants. These are Appointments, Order, Delivery, and Inventory management, CRM, Email Marketing, Dashboard, and Analytics.

- Many channels for customer support. Free users can contact the team via phone, email, live chat, or social media from 6 a.m.-6 p.m. Pacific, while 24/7 service is available for Plus and Premium users.

Cons:

- Not for all industries. Square is not a universal solution. Specifically, it is not recommended for high-risk businesses.

- Freezing accounts. Square follows rather strict user protection requirements and in case of any suspicious action, accounts are frozen without warning.

Special features:

- Website building functionality — with Square you are able to build an online store and launch it. Even though it may be a cookie-cutter solution, it may be enough to start a business and validate an idea.

- Restaurant-specific features — restaurant owners can create menus, visualize the floor plan of a restaurant, and add gratuity to checks.

- Retail-specific features — inventory tracking, barcode, and discount creation.

- eGift cards — Square emails and processes gift cards that can be used in your web store.

Square is best for:

- restaurants, food delivery, and retail stores as Square has specific built-in features for ordering, scheduling, inventory management, delivery, and payment;

- retailers who need to quickly start a fully-equipped online or offline store.

2Checkout (now Verifone)

2Checkout (2CO) is an all-in-one payment solution created specifically for online businesses. It provides two main business models. It can either work as a payment processor or as a merchant of record that handles taxes, invoicing, regulations, compliances, etc.

The company narrowed its international payments to small and mid-size businesses. In 2020, the company was purchased by Verifone, an international payment service provider, but 2CO will continue providing its services as before.

Among the company’s clients are ABBYY, Absolute, FICO, Kaspersky Lab, and many other companies from all over the world.

Pros:

- Variety of payment methods. 2Checkout works with 45 payment methods including all major credit cards, ACH, and digital wallets serving more than 200 countries and accepts payments in over 99 currencies.

- Flexible integration. 2CO allows both a hosted and integrated checkout process, so you can choose if you want to redirect the customers to a processor platform or let them provide the payment data on your site.

- Increased security. 2Checkout monitors all transactions and is 3D Secure and PCI certified. Assistance in complying with local regulations. The company provides an advisory team to help merchants comply with each country’s regulations.

- Good customer support. There is no telephone support, but the team responds immediately via email and live chat. In addition, the company provides a knowledge base and guides for developers.

Cons:

- High price. Compared to other payment gateways, 2Checkout is the most expensive. For example, 2Checkout vs PayPal: 2Checkout fees start at 3.5% plus 35 cents per transaction, versus PayPal’s 2.9% plus 30 cents per transaction.

- High account cancellation and hold rate. There are a lot of complaints from customers about 2Checkout holding funds and canceling accounts without notice.

- Requires developers. To integrate 2Checkout, you will need to hire developers.

Special features:

- Tax management — in case you opt for the Merchant of Record (MoR) plan, the system will calculate and collect sales taxes, VAT, and international taxes.

2Checkout is best for:

- small and mid-size businesses selling any kind of goods or services;

- platforms trading internationally. The solution supports a wide range of payment methods, currencies, languages, and local tax management.

WePay

WePay is an online payment service provider that grew out of a Y Combinator startup. Today, the company belongs to JPMorgan Chase.

With WePay, merchants accept payments from all major credit cards, digital and mobile wallets, and ACH transfers. WePay offers three plans that differ in features and fees — Link, Clear, and Core.

Among the users of WePay, are GoFundMe, ConstantContact, FreshBooks, Classy, and BigCommerce.

Pros:

- No merchant account is needed. WePay provides businesses with merchant accounts within their system.

- Increased security. WePay uses a number of data protection tools as well as machine learning algorithms and complies with safety standards.

- Great customization. WePay allows you to tailor the payment service according to your needs, and fees are quote-based and depend on the site’s level of complexity.

Cons:

- Requires developers. Integration of WePay is performed through the API and if you are not a specialist in this, it’s better to find a developer.

- Poor support. WePay provides no phone support. What’s more, numerous user complaints involve open tickets that were simply marked as resolved without finding a solution.

- Transaction holds and frozen accounts. There are many reported cases of freezing or canceling accounts without a sensible reason. Others complained that WePay held funds for several days; other payment systems usually resolve problems in a matter of hours.

Special features:

Same-day deposit — for merchants who bank with Chase, payments will be available in the merchant's bank account the same day.

WePay is best for:

- small and medium-sized companies;

- crowdfunding platforms, SaaS providers, donation websites, eCommerce sites;

- businesses that need payment services tailored to their unique needs.

How to apply this to your business

Online payments are an indispensable element of any modern online eCommerce platform. To enable online payments on your website, you need to integrate one of several payment gateways.

There are a large number of payment gateways available. But how to find the best fit for your company? There is no one-size-fits-all solution; on the contrary, there is a multitude of factors that come to bear on your decision. Here are the questions that you may consider when narrowing down the choice:

- What is your business and how large is your company?

- What type of online platform do you own/create (online marketplace, eCommerce website, crowdsourcing, etc.)?

- What is your business model (commission-based, flat fee, subscription, etc.)?

- What average transaction size do you anticipate?

- Will you process international payments? If yes, what countries are you going to serve?

- What payment methods do you need (debit and credit cards, ACH, local cards, etc.)?

- What specific payment options do you need (escrow, split payments, credit, pay-in-4, etc.)?

- Do you have a merchant account?

- Which way do you prefer to store the customers' financial data — on your server or on the payment gateway side?

- Do you need extra features like tax calculation, digital invoices, reports? The choices are endless.

- Does your website already have an integrated payment gateway? If yes, do you want to change it or reinforce it with additional payment methods/options?

- Are you technical enough to integrate payments by yourself or do you need developers?

Send us your answers to these questions, and we will give you a more precise estimate for payment gateway integration.

Need help choosing a payment gateway?

Contact UsRate this article!

5

Sign in with Google

Sign in with Google

Comments (0)